Alotta has the potential to be a company-maker.’ – Russell Ball, Strategic Advisor (1)

Hidden Gem’s Breakthrough: Positive Drill Results Emerge in One of the World's Largest Underdeveloped Gold-Copper Deposits! (1)

See why now could be the best time to start your research on Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG).

FORGE RESOURCES CORP. (OTCQB: FRGGF) (CSE: FRG)

Boasting Nearly 12,7 Million Ounces of Gold and 7,4 Billion Pounds of Copper – Canada's Yukon Emerges as Premier District for Critical Minerals (2)

Image Source (3)

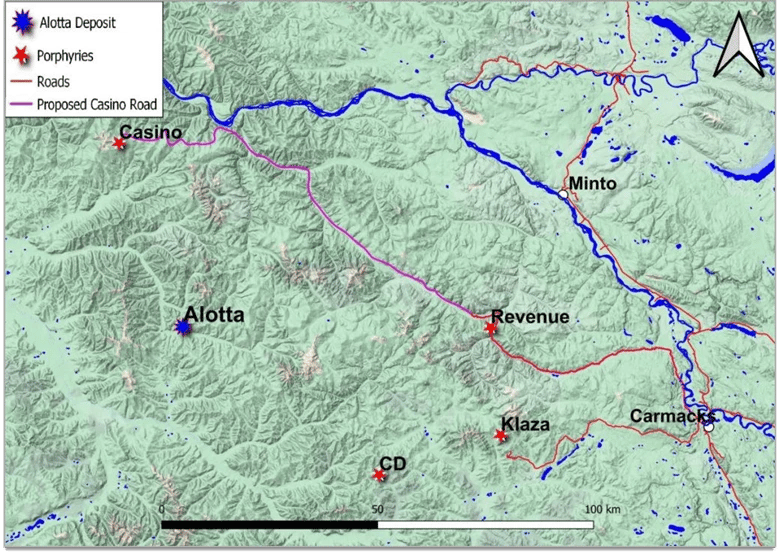

Nestled within Canada’s Yukon, an underexplored world-class gold district is gaining prominence, with the Casino copper-gold project at its forefront. Boasting nearly 7,4 billion pounds of copper and 12,7 million ounces of gold, Casino is poised to become the largest critical minerals mine in the country. (17)

A recent feasibility study underscores Casino's robust financial potential, further fueled by strategic investments from industry giants like Rio Tinto and Mitsubishi Materials. Rio Tinto's increasing commitment and Mitsubishi Materials' expertise validate Casino's prospects, signaling confidence in its future success. (2)

Situated in Yukon, known for its supportive regulatory environment and infrastructure upgrades, Casino benefits from its strategic location in a mining-friendly jurisdiction. These factors, coupled with its massive size and multi-decade mine life, elevate Casino to the status of a Tier 1 asset. (2)

As Casino garners attention for its promising outlook, focus turns to Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) , whose Alotta Property shares geological similarities with the Casino Deposit. (1)

Positioned for future exploration and development, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) presents an intriguing opportunity in the burgeoning Yukon mining landscape.

FORGE RESOURCES CORP. (OTCQB: FRGGF) (CSE: FRG)

7 Reasons Why Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) Could Witness Significant Upside Potential in 2024…

Positive Drill Results

Recently, impressive assay results were unveiled from the inaugural diamond drill holes at the Alotta gold-copper-molybdenum target, confirming extensive mineralization and indicating the potential for significant resource development by Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG). (1)

Geological Parallels with Major Depositsositive Drill Results

The Alotta Project's geological setting mirrors that of the significant Casino deposit, showcasing a similar potential for a substantial resource base. The Alotta Project has areas with gold, copper, and molybdenum that are even bigger than the Casino deposit, making it an exciting option for people looking for opportunities in places known for their rich ground. (7)(18)

Growth Potential

With plans underway to recommence drilling in May 2024 and focus on three key areas exhibiting coincident copper, molybdenum, and gold anomalies, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) is poised for further exploration and resource expansion, offering significant growth potential. (1)

BarChart Rating

Triggering an astounding 13 out of 13 Bullish Signals across Short-Term, Medium-Term, and Long-Term Indicators, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) has garnered recognition for its promising outlook. This flawless streak of bullish signals across diverse indicators has captured the market's attention, underscoring the company's robust position and growth potential in the mining sector. (15)

Contribution to Energy Transition

In addition to its focus on gold and copper, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG)’s strategic move into the coal sector through its interest in Aion Mining Corp. positions it to meet global energy needs and capitalize on strategic investment opportunities amidst the evolving energy landscape. (12)

Sustainable Growth and Value Creation

The strategic expansion into the coal sector and the development of projects like Alotta and Aion reflect Forge Resources Corp.'s commitment to sustainable growth. This approach not only aims to meet the current global demand for resources but also to create long-term value for industry stakeholders, positioning the company as a forward-thinking participant in the global mining industry. (7)(18)

Experienced Management Team

Led by President Lorne Warner and with the recent appointment of industry expert Matt Warder as Strategic Advisor, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) boasts a seasoned management team with diverse expertise in exploration, development, and strategic planning, enhancing its ability to capitalize on opportunities and navigate the complexities of the mining sector. (16)

FORGE RESOURCES CORP. (OTCQB: FRGGF) (CSE: FRG)

Forge Resources Corp. Strikes Gold: Positive Drill Results Emerge in Yukon's Alotta Gold-Copper Porphyry Target (1)

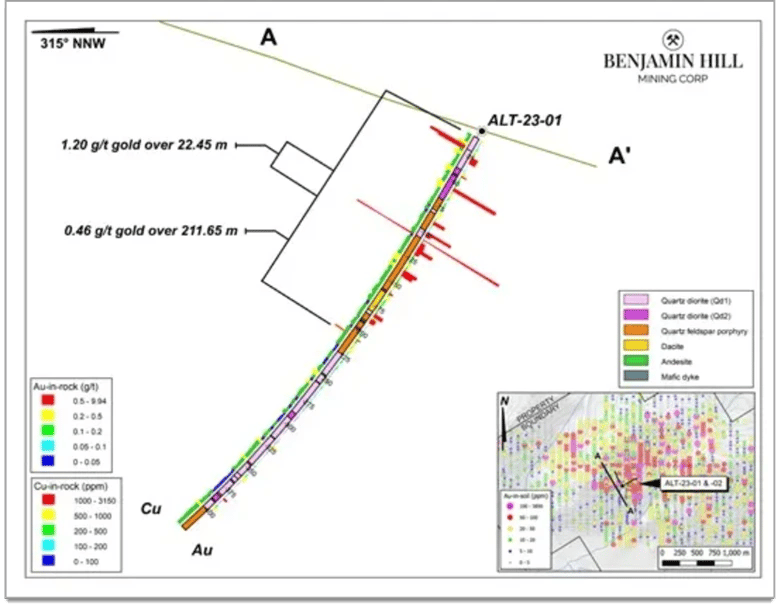

Image Source (5)

In a groundbreaking announcement, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) has unveiled the assay results from its inaugural diamond drill holes at the Alotta gold-copper-molybdenum target in the west-central Yukon. (1)

The results reveal an impressive intercept of 211.65 meters of 0.46 grams/tonne gold, affirming the presence of extensive porphyry-style mineralization in one of the world's largest underdeveloped gold-copper deposits. (1)

The two reconnaissance diamond drill holes, ALT-23-01 and ALT-23-02, targeted the south-central portion of an induced polarization chargeability high, coinciding with copper and gold anomalies in soil

samples.(1)

These holes mark the beginning of an exciting exploration journey for Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG), with plans already underway to recommence drilling in May 2024.

The upcoming drill program will focus on three key areas exhibiting coincident copper, molybdenum, and gold anomalies, signaling potential centers of porphyry mineralization. (1)

Image Source (5)

Image Source (5)

Alotta Project Overview & Key Points (18)

● Geological Significance Comparable to the Casino Deposit: The Alotta Project shares a geological setting very similar to the Casino deposit intrusive complex, a notable comparison given the Casino deposit's substantial resource base. As reported by Western Copper on June 22, 2021, the Casino deposit's Preliminary Economic Assessment (PEA) disclosed a resource estimate of 2.17 billion tonnes in measured and indicated categories, encompassing 7.4 billion pounds of copper and 12.7 million ounces of gold. Notably, the Alotta Project exhibits in-situ Gold/Copper/Molybdenum geochemical anomalies spanning an area of 4.0 X 1.0 kilometers, surpassing the current resource dimensions of the Casino deposit, thereby underscoring its potential magnitude and significance. (18)

● Indications of a Substantial Porphyry System: The magnetic depletion, high total potassium counts from surveys, and Induced Polarization survey outcomes align with the anomalous geochemical signatures of gold and copper in soil samples. These findings collectively point to the presence of an extensive, porphyry-associated hydrothermal system within the Alotta Project area, suggesting a promising target for further exploration. (18)

● Confirmation of a Large, Multiphase Porphyry System: Preliminary drilling efforts, encompassing the first two drill holes, have successfully confirmed the existence of a significant, multiphase porphyry system characterized by copper and molybdenum mineralization. All split core samples have been dispatched to ALS Laboratories for comprehensive analysis, with assay results eagerly anticipated. (18)

● Expert Management and Strategic Exploration: The Alotta Project benefits from the stewardship of Archer Cathro and Associates, leveraging the same expertise that facilitated the exploration successes at the Casino deposit. In collaboration with Benjamin Hill geologists, Archer Cathro has meticulously delineated the drill targets, setting the stage for a methodical exploration campaign aimed at unlocking the project's full potential. (18)

The Alotta Project, through its geological parallels to the esteemed Casino deposit and the initial confirmation of a significant porphyry system, emerges as a project of considerable promise. Under the guidance of experienced management and with strategic exploration targets in place, the project is poised for further investigation and potential development. (18)

Lorne Warner, President of Benjamin Hill Mining Corp., expressed his enthusiasm about the positive drill results, stating,

“We are very excited to see such positive drill results from our maiden drilling campaign at Alotta. We were initially attracted to the project for the sheer size of the geochemical anomaly, and I am pleased to see that our thesis has been reinforced by our maiden drill program. Planning has commenced for follow-up drilling this summer.” (1)

The sentiment was echoed by Russell Ball, Strategic Advisor to the Company, who commented,

“This is a very encouraging result from the first two reconnaissance holes at Alotta. With a coincident gold-copper-molybdenum geochemical footprint of over four-square kilometers, Alotta has the potential to be a company-maker. I look forward to working with the Company on the follow-up drilling program this summer.” (1)

Both drill holes, ALT-23-001 and ALT-23-002, exhibited multiple intrusive phases, including intrusive breccias displaying strong biotite alteration, carbonate veining, and mineralization of pyrrhotite, pyrite, chalcopyrite, and molybdenite as interstitial clots and stringers. (1)

Image Source (1)

Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) is a Canadian-listed junior exploration company primarily focused on advancing the Alotta project, situated 50 kilometers south of the Casino porphyry deposit in the Yukon Territory of Canada.

Additionally, the Company holds a 20% interest in Aion Mining Corp., which is developing the La Estrella coal project in Santander, Colombia.

The Company maintains strict quality assurance and quality control (QA/QC) procedures throughout its drilling and sampling processes. (1)

All drill core samples were prepared and analyzed by ALS in Whitehorse, Yukon, and North Vancouver, BC, respectively, ensuring the integrity of the assay results. (1)

The positive drill results from Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) signifies a significant milestone in the exploration of the Alotta project, underscoring the Company’s commitment to unlocking the full potential of this vast gold-copper-molybdenum deposit in the Yukon.

Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) is poised for further success in the dynamic mining landscape with plans for continued exploration and development.

With some analysts calling for $7,000 an ounce gold, now might be an opportune moment to begin exploring emerging mining companies such as Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG).

Gold Price Outlook: Is $10,000 an-Ounce Gold on the Horizon? (4)

Image Source (5)

As the global economic landscape continues to evolve, the glittering allure of gold has captured the attention of the market and analysts alike. (4)

With forecasts suggesting a potential surge to $7,000 an ounce by 2025, the precious metal remains a focal point for market observers. (4)

Banks such as Goldman Sachs, Citi, ANZ, and Commerzbank have revised their forecasts, bracing for the possibility of a banking crisis. Initially pegged at around $1,970 an ounce for the period between 2023 and 2026, Goldman Sachs analysts now anticipate a 12-month forecast of $2,050 an ounce. (4)

Meanwhile, Bloomberg Intelligence Strategist Mike McGlone foresees a bullish trajectory for both gold and its digital counterpart, bitcoin, by 2025. (4)

Gold has demonstrated remarkable resilience, with an 84% uptick since 2015, prompting speculation of a potential ascent to $7,000 by 2025. (4)

Looking beyond 2025, the long-term outlook for gold remains a topic of debate among commodity analysts. While many anticipate a continued upward trend, accurately forecasting prices for the next two decades poses significant challenges. Factors such as inflation rates, currency strength, interest rates, and market dynamics all influence gold’s trajectory. (4)

Despite the complexities surrounding long-term predictions, various scenarios have been proposed for gold’s future. (4)

Projections range from gold reaching $10,000 per ounce and potentially supplanting the US dollar alongside B-T-C, to the prospect of global gold scarcity by 2050 amidst surging demand. (4)

When considering 2030 forecasts, the $7,000 an-ounce scenario maintains traction. Economist Charlie Morris advocates for this milestone, highlighting gold’s status as a leading asset class in the 21st century, despite its lack of yield.

Similarly, investment analyst Jim Puplava predicts a significant bull market driven by demographic shifts and globalization, drawing parallels to his prescient forecast of a precious metals bull run at the turn of the century.

Amidst the speculation and anticipation surrounding gold’s future, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) stands as one little-known company as a potential beneficiary of these developments.

Besides gold, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) has also targeted copper, as demonstrated by its recent drilling activities. Holes ALT-23-01/02 tested the south-central portion of an induced polarization, chargeability high with coincident copper and gold in soil anomalies. (1)

The drill program is proposed to continue in May 2024, with the diamond drill and most camp equipment remaining on site over the winter.

The next drilling program will focus on at least three large “Bull’s eye” areas of coincident copper, molybdenum, and gold in soil geochemical anomalies that indicate the potential centers of porphyry mineralization.

With its strategic positioning and geological potential, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) presents an intriguing opportunity for those seeking exposure to the evolving gold and copper landscape.

SUBSCRIBE TO OUR NEWSLETTER FOR MUST READ REPORTS & NEWS.

Getting the Right News Before Everyone Else Does, is FREE...

Terms | Privacy Policy Message and data rates may apply. Reply STOP keyword to be opted out of the program. Reply Help for Help. We will never sell or share to third parties. For informational purposes only.

FORGE RESOURCES CORP. (OTCQB: FRGGF) (CSE: FRG)

Copper in Crisis: Challenges and Opportunities in Meeting Skyrocketing Demand (8)

Image Source (9)

As the global push towards sustainable energy intensifies, the demand for copper, a cornerstone of modern electrification, is soaring. Unlike previous years, where China’s economic shifts predominantly influenced copper prices, the metal’s current resilience stems from additional demand driven by the energy transition. (8)

Electric vehicles and the expansion of renewable energy infrastructure rely heavily on copper, making it a linchpin of the green revolution. (8)

However, the surge in demand comes at a precarious time for copper mining.

Delays, disruptions, and cancellations plague the industry, exemplified by the impending shutdown of First Quantum’s Cobre Panama mine and mining blockades in Minnesota. (8)

While these concerns are valid and warrant attention, they underscore the urgent need to ramp up copper production to support environmental initiatives like the low-cost energy transition. (8)

The significance of copper in the energy transition cannot be overstated. Vehicles, both electric and hybrid, require substantially more copper than their traditional counterparts, while the development of robust power grids amplifies the demand even further. (8)

As countries like China and India pivot towards electrified transportation and renewable energy sources, the need for copper becomes even more pronounced. (8)

Yet, the road to copper production is long and fraught with challenges. S&P Global’s analysis revealed that new mines typically take an average of twenty-three years from discovery to production. This prolonged timeline, coupled with escalating costs and productivity declines, underscores the urgency of supporting existing mining projects. (8)

Gary Nagle, CEO of Glencore, has sounded the alarm on an impending “massive copper deficit,” warning that the world is ill-prepared to meet the impending demand. Cost overruns and construction delays, as seen in projects like Teck’s Quebrada Blanca 2 expansion, further underscore the industry’s precarious position. (8)

The need for broad investment in new mining projects is clear. Initiatives like the Kinterra Battery Metals Mining Fund, which recently raised $565 million, offer a glimmer of hope in addressing this pressing challenge. Without a steady supply of critical metals like copper, achieving key sustainability goals, such as widespread electrification and renewable energy integration, remains uncertain. (8)

In this landscape, emerging mining companies like Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) stands out.

With its Alotta Property boasting geological similarities to the renowned Casino Deposit in Canada’s Yukon, which holds nearly 7,4 billion pounds of copper, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) presents a promising opportunity to contribute to meeting the growing demand for copper in the evolving global energy landscape.

But despite the global push towards sustainable energy, global coal exports and power generation hit new highs in 2023. (10)

Worldwide electricity generation from coal reached record levels, with thermal coal exports surpassing 1 billion metric tons for the first time. (10)

This surge in coal usage comes amidst widespread efforts to cut back on fossil fuels, particularly in regions like Europe and North America. (10)

Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) recently appointed Coal Industry Expert, Matt Warder, as Strategic Advisor, in line with the company’s 20% interest in Aion Mining Corp., which is developing the fully permitted La Estrella coal project in Santander, Colombia. (10)

FORGE RESOURCES CORP. (OTCQB: FRGGF) (CSE: FRG)

Meeting Global Energy Needs: Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) Ventures into Coal(12)

Image Source (13)

Despite the increasing emphasis on renewable energy sources, coal continues to play a vital role in meeting the world’s energy demands.

With 37% of global electricity and over 70% of steel production reliant on coal, its significance remains undeniable. (7)

Emerging markets, particularly in Southeast Asia, are expected to continue heavily relying on coal, fueling up to 39% of electricity needs by 2040. (7)

Moreover, coal contributes to various industrial processes beyond electricity generation.

Technologies designed to reduce particulate emissions and capture pollutants are widely deployed worldwide, ensuring cleaner coal-based energy production. (7)

Additionally, coal plays a crucial role in cement and aluminum production, where it aids in high-temperature kilning and provides energy for aluminum smelting. (7)

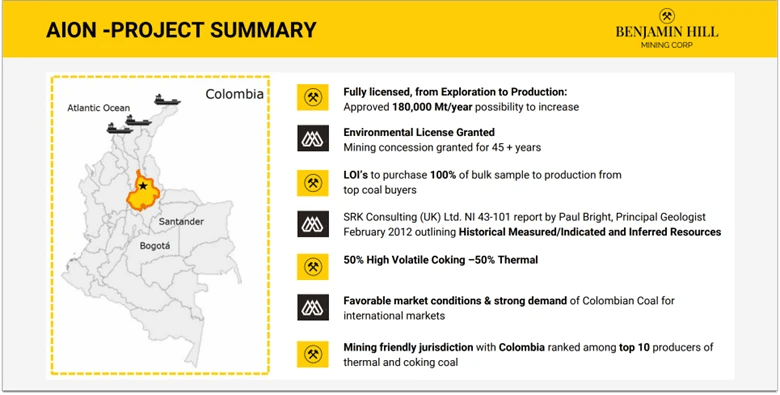

In recognition of coal's continued importance, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) recently acquired a 20% interest in Aion Mining Corp., which operates the Aion Project in Colombia, marking a strategic move into the coal sector. (12)

Image Source (7)

The Aion Project, holding full licenses for activities ranging from exploration to production, has received authorization for significant annual coal production. (7)

This initiative is especially relevant in light of the strong global demand for Colombian coal and the advantageous market conditions present today. (7)

The project's strategic location in Colombia, coupled with its access to vital regional coal mining infrastructure, positions it for streamlined and efficient operations. (7)

This is crucial in a country like Colombia, which is facing significant energy shortages, with an annual thermal coal consumption of 11.3 million metric tons against a backdrop of declining coal quality from a production volume of 99 million metric tons. (18)

Against this backdrop, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) has identified an unparalleled opportunity. (18)

The company's high-grade coal assets can blend with the nation's lower-quality coal, enhancing overall energy production efficiency. (18)

This initiative is further supported by Colombia's strategic deep-water ports, which facilitate the bulk export of coal to high-demand markets such as China and India. (18)

It's noteworthy that China, a major consumer, has been rapidly expanding its coal power capacity, with permissions for 106 GWh of new plants in 2022 alone—demonstrating the global market's vast appetite for high-quality coal.

Positioned advantageously near a deep-water port, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG)’s coal assets are well-placed for international distribution. (7)(18)

The company is embarking on a 180,000 metric ton per year bulk sampling program, which has the potential to expand up to threefold within a six-month period. (18)

Image Source (18)

This could lead to an impressive output of 500,000 metric tons per year, generating $25 million USD in profit annually and over $60 million USD in cash flows, assuming a $50 per ton profit margin.(18)

The La Estrella project, part of Forge Resources Corp.'s portfolio, underscores a commitment to high-quality coal production that meets both national and international benchmarks.

Meanwhile, the Aion project exemplifies operational excellence, with recent drilling confirming the presence and quality of significant coal seams, promising a lucrative revenue stream.

Under the guidance of an experienced and diverse Colombian management team, Aion Mining Corp. is navigating the coal industry's complexities with strategic acumen. (7)

By leveraging underground bulk sampling and historical exploration data, Aion aims to unlock the full potential of its coal reserves. (7)

Forge Resources Corp.'s expansion into the coal sector through the Aion project reflects the company's commitment to meeting the global energy demand and capitalizing on strategic investment opportunities. (7)(18)

This move positions Forge Resources Corp. to contribute significantly to the energy landscape, driving sustainable growth and creating value in the process.

Forge Resources Corp. Augments Strategic Expertise with Coal Industry Advisor, Matt Warder

In a move to strengthen its strategic capabilities, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) has appointed Mr. Matt Warder as Strategic Industry Advisor. With nearly two decades of experience in energy, metals, and mining analysis, Warder brings a wealth of expertise to his new role, where he will collaborate closely with the company’s senior management team to shape corporate development strategy.

As the founder and CEO of Seawolf Research, Warder has established himself as a prominent figure in management consultancy and financial analytics, delivering insightful consulting services across various sectors, including energy, metals, mining, and industrial supply chains. His previous roles as Director of Energy Capital Research Group and Principal Analyst for Coal, Iron Ore, and Steel Costs at Wood Mackenzie have further honed his analytical prowess and strategic insight.

With a Bachelor of Science in Chemistry, Warder’s academic background complements his extensive practical experience in the industry. His appointment comes at a pivotal moment for Benjamin Hill Mining Corp. as it embarks on ventures in the coal sector, underscoring the company’s commitment to tapping into emerging opportunities in the mining landscape.

CEO Cole McClay expressed confidence in Warder’s ability to provide strategic guidance tailored to the company’s objectives, stating, “The addition of Matthew’s expertise in specific coal industry analysis provides a strategic boost to the Company. His extensive experience will give Benjamin Hill a focused advantage as the company seeks to enter the global coal industry.” Warder’s appointment reinforces Benjamin Hill Mining Corp.’s commitment to strengthening its leadership team with top-tier talent as it navigates the complexities of the evolving mining sector.

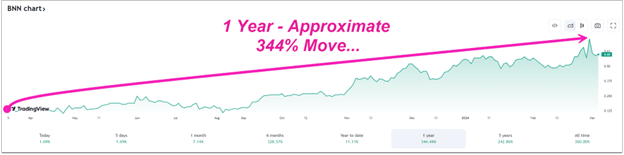

BENJAMIN HILL MINING CORP. (OTCQB: BNNHF) (CSE: BNN)

Benjamin Hill Mining Corp. (OTCQB: BNNHF) Scores Perfect 13 for 13 on Bullish Signals from BarChart (15)

Image Source (15)

Benjamin Hill Mining Corp. (OTCQB: BNNHF) is making waves in the investment world, appearing to be firing on all cylinders with an impressive streak of bullish signals.

According to BarChart.com, the company has received an astounding 13 for 13 bullish signals, indicating a strong upward trend across various indicators. (15)

The Trend Seeker® indicator is flashing bullish, signaling a positive trajectory for Benjamin Hill Mining Corp. (OTCQB: BNNHF).

In the short term, the 20-day moving average, along with multiple MACD oscillators ranging from 20 to 200 days, are all indicating bullish sentiment. The 20-day average volume also reflects a bullish outlook, further reinforcing the positive momentum. (15)

Medium-term indicators are equally bullish, with the 50-day moving average and various MACD oscillators between 50 and 200 days all pointing towards a favorable trend. The average volume over the past 50 days mirrors this sentiment, indicating strong bullish momentum in the medium term. (15)

Long-term indicators continue to paint a bullish picture, with the 100-day, 150-day, and 200-day moving averages all signaling a positive trajectory. Additionally, the 100-200 day MACD oscillator further supports the bullish outlook for Benjamin Hill Mining Corp. (OTCQB: BNNHF). (15)

With a flawless streak of bullish signals across trend seekers, short-term, medium-term, and long-term indicators, Benjamin Hill Mining Corp. (OTCQB: BNNHF) is capturing the attention of the market.

On Canada’s CSE, Benjamin Hill Mining Corp. (CSE: BNN) has surged approximately 344% over the last year.

This remarkable performance underscores the company’s strong position and potential for growth in the mining sector. As the public continues to monitor these bullish indicators, Benjamin Hill Mining Corp. (CSE: BNN) (OTCQB: BNNHF) remains a compelling prospect in the market.

Benjamin Hill Mining Corp. (OTCQB: BNNHF) (CSE: BNN) is led by a seasoned and dedicated team of professionals with a wealth of experience in the mining industry.

Benjamin Hill Mining Corp. (OTCQB: BNNHF) (CSE: BNN)’s leadership team is composed of individuals with extensive backgrounds in various facets of mining, and is committed to not only enhancing shareholder value but also prioritizing responsible mining practices and community well-being. (16)

With expertise spanning from management consultancy to geological exploration and community development, our team is poised to drive sustainable growth in the Colombian mining sector. (16)

Meet the individuals who are shaping Benjamin Hill Mining Corp. (OTCQB: BNNHF) (CSE: BNN)’s future and contributing to positive change in the communities they serve.

FORGE RESOURCES CORP. (OTCQB: FRGGF) (CSE: FRG)

Executive & Technical Team (16)

COLE MCCLAY - CEO & DIRECTOR

Mr. McClay is a key figure in securing venture capital and serves as a consultant for global industries including mining, exploration, agriculture, and healthcare. With over a decade of senior management experience, he plays a pivotal role in shaping corporate strategy, operations, and marketing. He excels in team leadership, from startups to full company acquisitions, and holds a Bachelor of Commerce Degree from Royal Roads University. (16)

LORNE WARNER - PRESIDENT, P.Geo

Mr. Warner is a geology graduate from the University of Alberta (1986) and a registered professional geologist in NWT and Nunavut. With over 30 years of experience in underground and open-pit mining mineral exploration, he has worked for major mining companies like Noranda Exploration and Placer Dome Inc. Notably, Mr. Warner’s team made significant discoveries, including the extension of the Detour Lake Gold Deposit in Ontario after its closure by Placer Dome. He also played a pivotal role in discovering the Falea North Zone (Uranium, Silver, Copper Deposit) and the Fatou Main Gold Deposit, both located in Mali, West Africa. (16)

GREG BRONSON - SENIOR PROJECT GEOLOGIST, DIRECTOR, P.Geo

Mr. Bronson is a highly experienced geologist with 30 years of expertise in mineral exploration and mineral project development. He holds P.Geo. designations from APEGBC and NAPEG, along with a B.Sc. in Geology from the University of Alberta. Mr. Bronson serves as a qualified person for Benjamin Hill Mining Corp. and holds director positions at Sentinel Resources, Bathurst Metals, and Avanti Energy. (16)

DR. GUOWEI ZHANG - SENIOR ADVISOR, P.Geo

Dr. Zhang is a highly experienced Structural Geologist with over 30 years of expertise as a consulting geologist, particularly renowned for his specialization in structural geology. He earned his PhD from McGill University in 1994 and has conducted extensive work in Canada, the United States, Asia, and Africa. Dr. Zhang is recognized as a professional geoscientist and holds the esteemed title of Fellow of the Geological Association of Canada.

JUAN J. DUARTE BRAVO - DIRECTOR

Mr. Duarte Bravo is an experienced Lawyer, serving as a counselor and legal representative for international mining companies in Mexico for more than 20 years. He is recognized as a leader in the acquisition of mining concessions that encompass government, private, and ejido-owned properties. Mr. Bravo excels in managing corporate environmental compliance, expediting mine exploration and exploitation permits in protected natural areas, and securing permits for Mexican territorial water rights and development environmental permits. (16)

TYRONE MCCLAY - DIRECTOR

Mr. McClay is a seasoned management consultant who specializes in working with mining companies in both South America and North America. His expertise spans corporate finance, investment banking, and capital markets, with a specific focus on the mining sector. He possesses exceptional skills in facilitating public and private equity offerings, conducting valuations, providing fairness opinions, and overseeing merger and acquisition transactions. Additionally, Mr. McClay has served on the boards of Cicada Ventures, Stealth Resources, and Mosquito Creek Mines. (16)

RUSSELL BALL - SENIOR ADVISOR

Russell Ball is a seasoned mining executive with over 30 years of experience, including notable roles as EVP and CFO at Newmont Mining and Goldcorp. With a background in finance and a track record of successful leadership, he is a respected figure in the industry. Currently, Russell serves as a Non-Executive Chair and director for several prominent mining companies, contributing his extensive expertise to their growth and development. (16)

Colombia Project Team

BORIS CORDOVEZ VARGAS - Country Manager – Colombia

Mr. Cordovez was a member of the Board of Directors of the Federation of Colombian Coal Producers (FENALCARBON) for 10 years, and currently sits on the board of the Association of Railway Engineers of Colombia (AIFC). Boris was the operator of a thermal coal mine in Cesar, Colombia with CERROL S.A. for 3 years, and founder of C&ENER SAS, a company focused on the development of mining and energy projects. Together with Vale Do Rio Doce, Rio Tinto and BHP Billiton, they explored nearly 800,000 hectares in Colombia for various resources. He has acted as a consultant for infrastructure projects such as Puerto Sinú, Alternate Airport of Villavicencio. He studied International Trade at Tadeo University and completed his Master's Degree in Multimodal transport. (16)

CAMILO CORDOVEZ AMADOR - VP FINANCE

Camilo has been in investment banking for the last 14 years as Managing Partner of PrimeCap S.A.S. and Investment Banking Associate of Yun Capital, NYC. He brought projects to the firms in sectors such as energy, transportation, agriculture, infrastructure, and real estate. He worked as an investment advisor in equity funds for Professional de Bolsa in Colombia, with AUM of $700m. With Colombian Mineral Resources PLC made a listing at ISDX London for US$ 75M market cap. Most recently with C&ENER S.A. as a financial consultant, commodity broker as manager of business development in Mining and Infrastructure. Camilo holds a Bachelor degree in Finance and Business from the EU University of Barcelona. He was certified in International Corporate Finance from Columbia Business School NYC and Private Equity Funds from EAFIT University. (16)

GERMAN ANDRES GARCIA QUINTERO - MINING ENGINEER

Mining Engineer from the Francisco de Paula Santander University (UFPS), Cúcuta Norte de Santander, Specialized in environmental engineering from the Industrial University of Santander (UIS), Bucaramanga Santander, with more than 6 years of experience in the exploitation of underground coal mines. He worked for coal producing companies in the Norte Santander region, holding positions as resident mining engineer and then mine manager for Minas La Aurora, technical advisory engineer for the Cooprocarcat mining cooperative for more than 3 years reaching production ceilings of 5000 Mt/month. (16)

SERENEL SOLOZA - CIVIL ENGINEER

Civil Engineer with more than 17 years of experience in different areas of engineering: business management, engineering project management, construction management and residence (infrastructure, private and institutional buildings, earthworks, hydraulic structures, slopes, handling of management and residence of works supervision, budget preparation, execution of purchasing and investment programs, direction and management of SGC, management of personnel, mining operations and infrastructure, residence, supervision and consultancy of works, development of systems of georeferenced information, environmental impact studies, elaboration of contracting documents, diagnosis of the physical state of constructions, information management, elaboration of cadastral and infrastructure censuses. (16)

ELVIRA VERA BOLAÑO - SOCIAL & ENVIRONMENTAL MANAGER

She graduated from the Industrial University of Santander (UIS), Specialist in Family Law-National University of Colombia (UNAL). With more than 11 years of work experience in which she has been able to perform in different areas of Social Work within the public and private sector, Elvira has led community processes in different municipalities of the departments of Santander, Meta and Magdalena Medio area. Much of the professional experience has been in the coordination of social, educational and community projects for the development of projects in oil and mining, in which interdisciplinary and transdisciplinary work teams have been led with excellent results and positive community impact. Before joining AION MINING, she has worked as a social professional in the company Business and Quality Services, in the environmental compensation project of the company Ecopetrol S.A for the Orinoquía region. (16)

DANIEL ESCOBAR PINZON - JUNIOR GEOLOGIST

Junior Geologist graduated from the Industrial University of Santander, with experience in the Oil and Gas industry and with skills developed in Structural Geology, Field Geology, Geographic Information Systems (GIS), Sedimentology and Petrophysics. He has skills in Technical and GIS geological software. In 2020 he was on the winning team of the Imperial Barrel Award regional Latin America and the Caribbean (IBA LACR) organized by the American Association of Petroleum Geologists (AAPG). He has participated in different geology courses and symposia where he has developed different technical and soft skills. He currently works as a Junior Geologist for AION MINING CORP. (16)

JUAN CARLOS ZÚÑIGA VERA - TECHNICAL ADVISOR

Geologist specialized in management and development of geological-mining projects. 32 years of experience in the entire value chain of the industry, Titling, Formalization, exploration, mapping, and auditing in government, private and multinational companies. He holds a Master of Science Degree in Geology from the Krivoi Rog Ukrainian University and MBA from Santo Tomas University of Colombia and other studies in evaluation of mining resources, Minex, Arcgis 10, English, NLP, Diploma in research and development, project evaluation, appraisals and mining environmental legislation. (16)

Hidden Gem’s Breakthrough:

Positive Drill Results Emerge in One of the World's Largest Underdeveloped Gold-Copper Deposits! (1)

See why now could be the best time to start your research on Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG).

FORGE RESOURCES CORP. (OTCQB: FRGGF) (CSE: FRG)

7 Reasons Why Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) Could Witness Significant Upside Potential in 2024…

Positive Drill Results

Recently, impressive assay results were unveiled from the inaugural diamond drill holes at the Alotta gold-copper-molybdenum target, confirming extensive mineralization and indicating the potential for significant resource development by Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG). (1)

Geological Parallels with Major Depositsositive Drill Results

The Alotta Project's geological setting mirrors that of the significant Casino deposit, showcasing a similar potential for a substantial resource base. The Alotta Project has areas with gold, copper, and molybdenum that are even bigger than the Casino deposit, making it an exciting option for people looking for opportunities in places known for their rich ground. (7)(18)

Growth Potential

With plans underway to recommence drilling in May 2024 and focus on three key areas exhibiting coincident copper, molybdenum, and gold anomalies, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) is poised for further exploration and resource expansion, offering significant growth potential. (1)

BarChart Rating

Triggering an astounding 13 out of 13 Bullish Signals across Short-Term, Medium-Term, and Long-Term Indicators, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) has garnered recognition for its promising outlook. This flawless streak of bullish signals across diverse indicators has captured the market's attention, underscoring the company's robust position and growth potential in the mining sector. (15)

Contribution to Energy Transition

In addition to its focus on gold and copper, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG)’s strategic move into the coal sector through its interest in Aion Mining Corp. positions it to meet global energy needs and capitalize on strategic investment opportunities amidst the evolving energy landscape. (12)

Sustainable Growth and Value Creation

The strategic expansion into the coal sector and the development of projects like Alotta and Aion reflect Forge Resources Corp.'s commitment to sustainable growth. This approach not only aims to meet the current global demand for resources but also to create long-term value for industry stakeholders, positioning the company as a forward-thinking participant in the global mining industry. (7)(18)

Experienced Management Team

Led by President Lorne Warner and with the recent appointment of industry expert Matt Warder as Strategic Advisor, Forge Resources Corp. (OTCQB: FRGGF) (CSE: FRG) boasts a seasoned management team with diverse expertise in exploration, development, and strategic planning, enhancing its ability to capitalize on opportunities and navigate the complexities of the mining sector. (16)